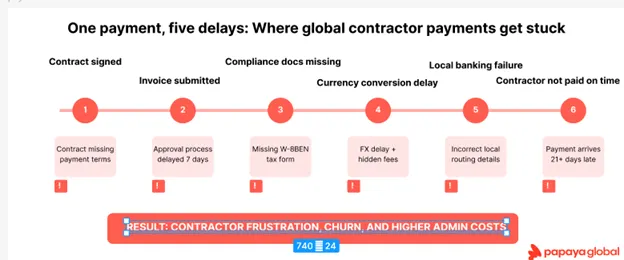

Most global enterprises only realize how much friction exists in their global payment operations after something breaks.

A freelancer in Mexico isn’t paid for three weeks. A partner in Indonesia runs into banking issues. A compliance issue in France interrupts a standard payroll run. I’ve seen all of this happen repeatedly. And in nearly every case, the underlying problem is the same: a fragmented process that was never designed to scale.

Managing it often feels like juggling a dozen calendars, each running in a different time zone, with no reminders and no central view. One market uses a legacy banking partner with three-day clearance times. Another requires paper tax forms to be mailed and scanned. Some vendors invoice in USD, others in local currency, and none of it flows into a single system. What looks simple on a spreadsheet turns out to be a mess of mismatched formats, regulatory blind spots, and manual approvals that don’t talk to each other.

As businesses grow internationally, they often pull together a combination of local vendors, bank transfers, ad hoc compliance solutions, and spreadsheets. What starts as a stopgap solution

quickly turns into an ecosystem of risk, delays, and blind spots for finance.

Many companies can launch a global tech stack in days, but still struggle to make a basic payment across borders. That kind of operational gap doesn’t just cause short-term delays. It adds up over time and limits the company’s ability to move quickly and plan with confidence.

Instead of continuing to patch around these gaps, companies need a new approach. One that creates a consistent experience for every worker and provides full oversight for finance and operations leaders.

Why local fixes don’t scale

Most CFOs can retrace the path that led to complexity. It often begins with urgency—a quick hire in a new market or an initiative that needs fast execution. To keep things moving, a team plugs in a local payroll vendor. Then, they hire another partner for contractor payments. Then, someone builds a tracker to reconcile the results.

Multiply that by a few regions and a few dozen contractors, and the process becomes hard to follow and even harder to manage.

Local providers offer fast setup and regional expertise. But when each one follows a different process, format, and timeline, alignment is incredibly difficult. And basic questions about workforce costs or payment status become harder to answer.

Here’s what I see most often:

-

Finance teams are managing payment timelines, tax forms, and vendor SLAs without a consistent process.

-

Spend visibility is limited. There’s no single place to view total costs, currency fees, or delays by region.

-

Issues are often discovered late, usually when a payment fails or a tax document is missing.

-

Local regulatory changes trigger wide disruptions, and fragmented systems make it difficult to respond.

Some teams are still trying to run global contractor payments from spreadsheets and shared inboxes. It might seem manageable in the short term, but over time it creates risk and slows down the business.

Growing globally requires more than opening new markets. It calls for operational systems that can support a larger, more distributed workforce without losing control in the process.

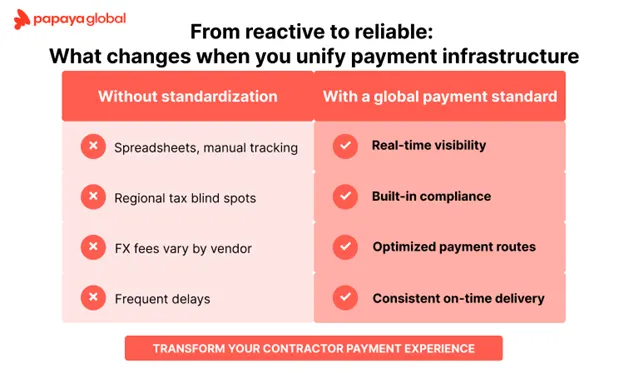

What a global payment standard actually looks like

In many global organizations, the process of paying contingent (external) workers has always involved compromise. Teams trade speed for compliance or flexibility for visibility. Eventually, these tradeoffs start to feel like a permanent part of the job.

A global payment standard is not a new product or feature. It is a single operating model for managing workforce payments across countries. It includes one system for onboarding, documentation, tax handling, payment routing, and reporting. Every country still has its own rules, but they are all processed through the same infrastructure.

With this kind of unified approach, the compromises begin to disappear. Companies no longer need to restart from scratch every time they enter a new market.

Here’s what it looks like in practice:

-

Contractors receive payments on time and in the correct currency, without delays caused by local banking limitations.

-

Finance teams have a live view of workforce spend, broken down by market, payment method, and cost center.

-

Local compliance requirements are handled within the workflow, instead of being tracked manually.

-

Payments are routed through the most efficient paths, which lowers both costs and failure rates.

-

Workers have more control over how and when they get paid, with options for currency selection, preferred timing, and payout methods that fit local expectations.

With the right infrastructure in place, internal teams spend less time coordinating and more time focusing on performance. Decisions move faster. Forecasts improve. Global operations become more consistent and less reactive. Just as important, the contractor experience becomes smoother and more respectful. Workers are paid without delays or confusion, which helps build trust and strengthens long-term relationships.

This kind of system doesn’t eliminate every challenge, but it creates a stable foundation for companies that want to scale with confidence.

Building better foundations for global work

Global hiring is accelerating, and the systems that support it need to keep pace. Whether you’re working with freelancers, contractors, or any part of the extended workforce (contingent workforce), a unified payment infrastructure provides the clarity and control needed to operate at scale.

To see how leading companies are managing payments across their extended workforce, learn more about Papaya Global’s Contingent OS solution.