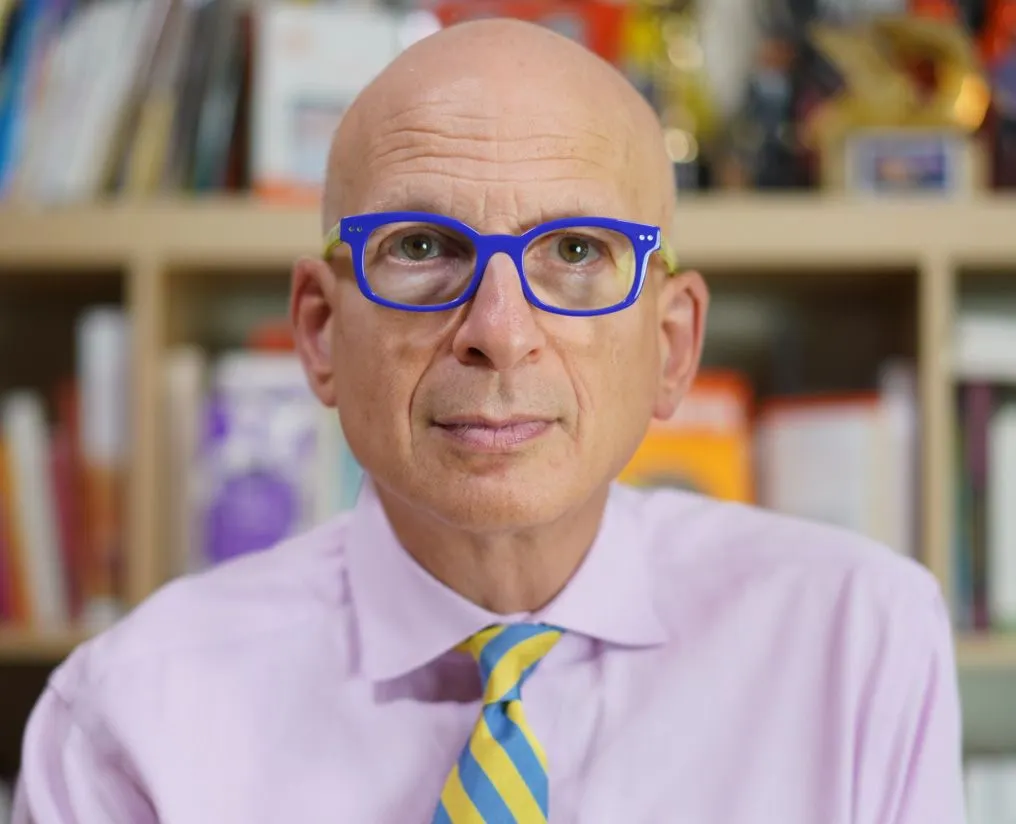

Few business thinkers have experienced and shaped how organizations approach change quite like Seth Godin.

Before becoming the bestselling author of “This Is Marketing”, “Purple Cow” and more than a dozen other books, Godin helped pioneer online marketing during the internet’s first boom.

As founder of Yoyodyne, one of the earliest digital direct-marketing firms, and later as Yahoo’s vice president of direct marketing after its 1998 acquisition of his company, Godin played a key role in shaping how brands reached customers in the early days of the web. His 1999 book “Permission Marketing” continues to be a foundational text for modern digital strategy.

In a conversation with CFO.com on the sidelines of the World Business Forum on Nov. 6, Godin looks back on lessons from that era and connects them to the challenges finance leaders face today as they navigate AI and other emerging technologies. He discusses why many CFOs misunderstand the “C” in their title, the comparison between the dot-com bubble and the AI bubble, how storytelling applies to boardroom communication and why leading change often means getting comfortable with discomfort.

Seth Godin

Best-selling business author

Notable previous positions:

- Founder and CEO, Squidoo

- Vice president of direct marketing, Yahoo

- Founder and CEO, Yoyodyne

This interview has been edited for brevity and clarity.

ADAM ZAKI: A lot of people compare AI to the dot-com bubble. Do you see any similarities between what’s happening now and what happened then?

SETH GODIN: I was part of the group that started the dot-com bubble. The internet crashed twice in my career, but that was a financial crash. There’s more internet than ever before. The internet never slowed down. It was always about the financial pluses and minuses, the question of whether someone was going to make money in a certain position.

There is zero doubt in my mind that AI is overhyped, and that many people who think they’re about to make a lot of money will not. But AI as a tool isn’t going anywhere. It’s getting bigger. Whether or not that’s a financially smart thing for current investors, I don’t know.

You can look at the lines that OpenAI is drawing and say nothing scales to infinity. To those people, I would tell them not to buy stock. But what’s clear is that there will be way more users than shareholders of AI. I don’t understand how that’s not going to keep getting bigger for the rest of our lives.

CFOs are expected to lead on AI adoption and innovation while managing risk. How do you believe they can balance forward thinking with healthy skepticism?

I don’t think most CFOs take the ‘C’ part seriously. Most CFOs, like most CIOs, did a really good job at the job before this and got promoted, and they think their job is to keep doing what they used to do, which is a really good job of working for the CFO.

But the nature of being a CFO is to say, ‘Other than the processes and approaches we currently have, what could I do to change the conditions of this organization so that we get different outcomes?

Your job is to make change happen. Your job is to make decisions. Your job is to understand what problems you’re trying to solve and which ones you’re not trying to solve. That’s the work. But most people who care a lot and work very hard are working in the business, not on the business.

So I would begin with that. Is there anyone in your industry, in any competitor mindset, who is changing the rules of the game more than your organization is changing the rules? Because if they are, you’re going to fall behind.

If we think about straight-up finance, the people who built Vanguard and Fidelity completely trounced all the other people in finance. They didn’t do silly, risky things. They just looked at the system, reconfigured how the system could solve problems and built a different sort of entity.

When Cisco was growing so fast 20 years ago, their CFO thought to ask ‘What if reporting didn’t take 90 days every time, but we could close our books in three days?’ What would our competitive advantage be in the public markets? What would happen if we built an entity that could acquire other entities not once in a while, but on a regular basis? Those are the kinds of CFO choices that earn you your salary.

So that’s where I begin. Because most of the time, when someone says, ‘I need to be the skeptic,’ what they’re really saying is, ‘I want everything to stay the same but be a little cheaper.’

I really like this quote from you: “People don’t buy goods and services. They buy stories and relationships.” Does that apply to how CFOs communicate with their boards or private equity owners, where they often have limited autonomy but all the responsibility?

When I talk to finance people, I say, ‘Do you own the most efficient, cheapest car ever made? Are all your investments at the place with the highest number of basis points?’ Even financial professionals honestly have to say, ‘Well, no, I bought this car because it makes me feel good.’

All of these decisions — the fact that someone keeps their stock in a company that doesn’t have certain fundamentals — come down to status, affiliation and how it makes me feel.

“CFOs need to remember this: Some companies are marketing driven and some are market driven. Marketing driven means, do we do stuff that makes the marketing department happy? Market driven means, are we doing something that makes the market happy?”

Seth Godin

Best-selling author and former vice president of direct marketing, Yahoo

The same thing is true for boards and private equity. There’s almost nobody who is completely optimized on a Milton Friedman ROI basis. So what story are they telling themselves?

If, as a CFO, you’re telling yourself the story that you don’t have any agency, that your hands are tied, I would say either you should get a new job because you’ve just sacrificed your future, or you should tell yourself the truth about what’s actually there.

People might not applaud everything you do, but they’re probably not going to fire you for a kind of innovation. It’s just going to be uncomfortable. Are you willing to be uncomfortable? Because now you have a C in your title.

A CFO recently joked that marketing is “playing hopscotch” with AI. You’re well aware of that legacy tension between finance and marketing. How do you believe CFOs can set limits on marketing’s AI experiments without discouraging innovation or damaging collaboration?

If innovation is about solving problems, I don’t need to keep it in line. I just need to make sure it’s solving the problems that need to be solved. Most people, including people in marketing, don’t understand what marketing is. Marketing is not hype or promotion or hustle or lying. Marketing is telling a true story that spreads.

If your marketing department is telling a true story that spreads, your organization is going to do better every single day. It doesn’t cost any money. Ads cost money. Marketing doesn’t cost money. Marketing is choosing how to show up in the world.

So you don’t want finance to slow down the marketing department. You want to focus on [working with] the marketing department.

CFOs need to remember this: Some companies are marketing driven and some are market driven. Marketing driven means, do we do stuff that makes the marketing department happy? Market driven means, are we doing something that makes the market happy?

Part of the CFO’s job is to get the marketing department to not worry about the marketing department, but to worry about the market.

More CFOs are being told to get on stage and tell their company’s story. Their boards want them out there representing the brand, but many have little public speaking experience. How should they prepare?

It’s easy to be better than you are now by doing it. You can’t prepare. Just do it and then do it again.

The same way you learned how to ride a bike, the same way you learned how to walk. The number of people who are going to put in the time to do what I did today is very small. I’m not worried. I don’t feel threatened.

Go give some talks and measure the right thing. The right thing is, did you change the people in the room? Did you read your script without making a mistake? Did you put 18 bullet points on a slide? Did you make a change happen?

Don’t start with a 45-minute talk. Start with three-minute talks. Start with talks about things that have nothing to do with your business. Can you give a toast at a wedding that someone’s going to remember three days from now? If, as a CFO, you can’t do that, you’re not practicing your communication skills enough.