Developing and crafting a leadership style is seldom taught in business schools but is critical for CFOs and their fellow executives looking to grow their organizations. Whether it’s how decision-making is carried out, tasks are delegated, ideas are expressed or concerns are relayed, these are all ways great leaders and good leaders can separate from one another.

Recently, CFO.com sat down with various business leaders who, throughout their careers, have either provided insight on or implemented different ways leadership can create a better working environment for employees. Through practices like being comfortable with failure, salary transparency and authenticity, CFOs can simultaneously be more approachable and effective — a skill that is developing into a requirement for those leading younger generations.

1. Make your financial data and employee salaries open to all

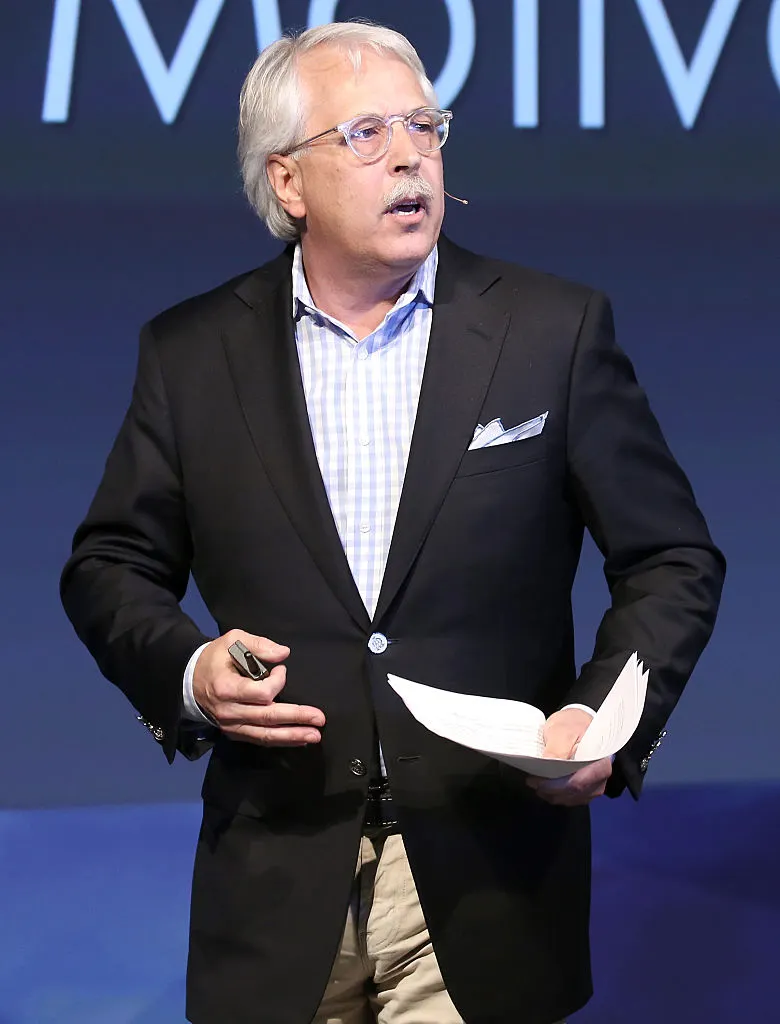

Gary Hamel, founder of the global consulting firm Strategos, is known for his ideas around eliminating corporate bureaucracy. When asked about the importance of making financial data available to everyone in the organization, he said those who have done so have seen success. He cited John Mackey, the CEO of Whole Foods, who, before the company was bought by Amazon, made margins, details of the P&L and all compensation rates available to employees throughout the company. According to Hamel, these are ways CFOs can empower both their employees and companies alike with data.

“This idea hit me many years ago, and it still holds up today,” said Hamel. “I think the default [for CFOs] should be openness. You have to have a really good reason not to share that type of data with your team. At [Whole Foods], employees knew the margins and profitability of every item, and that information went into how they made their merchandising selections and what goes on the shelves. If you don’t have that information available, you can’t expect your people to think like business people and do what’s best for the business.”

Salary transparency, an area where CFOs have expressed mixed feelings, is a policy Hamel recommends for CFOs looking to be more transparent. “I believe all salary data should be shared across the company. It’s a good way to ensure that you don’t have anomalies and that you don’t have a strong leader somewhere that has been able to lever up the pay of their subordinates at the expense of everyone else.”

Hamel spoke about how making this data accessible not only drives transparency, which in turn drives employee satisfaction and leadership credibility but also fosters a culture ingrained in honesty and integrity around compensation. He hinted that CFOs and their fellow leaders shouldn’t hide behind a moat of data protection to avoid tough conversations about differences in compensation.

“All leaders have to be able to have a conversation about why John makes twice as much as [an employee asking for a raise],” he said. “We need to be able to articulate the extra responsibilities that person has, what problems they are solving and what justifies their pay.”

2. Allow for flexibility around failure

Amy Edmondson, the Novartis professor of leadership and management at the Harvard Business School, has built a career promoting the idea of creating operationally safe spaces where employees aren’t fearful of taking risks. She says that in finance and accounting, a strong distinction needs to be made along with an approach to “catch and correct” failure to create learning opportunities. “Nobody likes failure, but there is value in the willingness to tolerate failure because it is part of the critical path toward success,” said Edmondson.

“CFOs are not in the business of celebrating failure, but human beings are fallible, they make mistakes, and that does not mean our products or people are faulty; it means we need to [proactively] be in the business of catching and correcting,” she continued. “This is essentially what high-quality accounting groups and finance teams do — they are in the business of catch and correct.”

Edmondson said CFOs who strive for perfection are setting themselves up for failure. “If [a CFO] is delusional in the idea that ‘oh, we can’t fail because the stakes are too high,’ then they’re at more of a risk of failing because they’re not proactively catching and correcting. If you’re in the perfection business, it’s a pipedream. It doesn’t exist; there is no human perfection.”

3. Authenticity is the key to great leadership

Anne Chow, the former CEO of AT&T Business, credits communication to not only her ability to grow at AT&T for over 30 years but also her ability to create enjoyable working experiences for both the employees at her company and the CFOs she worked with. According to Chow, personalities and the ability to resonate with someone are critical in leadership, and the best way for business leaders to do that, she says, is to just be themselves.

“Over time, I have found that authenticity in leadership has grown in importance,” said Chow. “No one wants to work for people they don’t relate to. We don’t want to work with people we don’t believe in or don’t trust and respect.

“I am a child of immigrants. I was born here, but my parents came from Taiwan to New Jersey in the ’60s, and I never really fit in,” said Chow. “I felt the same way when I entered the workforce, but I knew that because I was different, my voice would be heard if I was just myself. The more comfortable I got with being a leader, the more I was able to truly be myself, and the faster I succeeded and grew professionally. The more I did this, the more I realized that authenticity is a gift [for business leaders], because it helps our people relate to us more and creates a better environment for teams to succeed.”

When asked what makes a great CFO, Chow brought up authenticity as well as being able to be a true co-pilot of the business.

“What has always made a great CFO to me is not someone who just understands the ins and outs of financial performance, accounting, FP&A and investor relations but someone who is a true strategic partner,” said Chow. “In my experience, the best CFOs were always my fallback person. I depended on them and their expertise. Not that partners and board members weren’t capable, but a good CFO understands the full scope of the business, which is not easy.”

4. Modernize your FP&A approach

The ambiguity around FP&A, especially as the usage of tools within the approach continues to develop, makes clarity critical. For CFOs focusing on this, honing in on exactly what your FP&A tasks aim to achieve, and what tools and methods will be used over time to accomplish those goals, is increasingly important. According to Nick Araco Jr., CEO of The CFO Alliance, some of the misconceptions around FP&A stem from finance and accounting’s branding problem.

“I think FP&A has turned into a gateway competency with different definitions, but the application of the process is still consistent,” said Araco Jr. “It’s important to make sure, as CFOs, we are challenging and validating the decisions we make in the immediate, short term and long term, with the supporting information that gives us the best ability to make that prediction or decision.”

Araco Jr. stressed that alongside data’s growing importance, exactly how decision-making will work around FP&A is important for CFOs to map out. “CFOs must be dedicated to ensuring they have enough information for both themselves and their people to ask the right question. FP&A is meaningful, and it is becoming harder given the tech stack’s complexity in some ways, but there needs to be a central truth around data when it comes to FP&A’s decision-making process.”