The following is a guest post from Michael Paull, president and CFO at The Ahola Corporation. Opinions are the author’s own.

For years, EBITDA has been criticized as unreliable, inconsistent and prone to distortion. It’s non-GAAP, and even though it is ostensibly self-defined in its name, there is no common definition or application. Its definition is often industry-specific and situationally dependent. Even under heightened public company scrutiny, definitions vary widely, and private companies often take additional liberties. If a standard did exist, companies would still differ on what qualifies as an addback, particularly for non-operating or non-recurring items. When something is not codified by the FASB or other governing body, companies are left to their own judgment, leaving room for subjective interpretations. This is one reason adjusted and normalized EBITDA metrics have proliferated, each reflecting a slightly different view of the company’s underlying earnings.

Although many CFOs and others would like to move away from this controversial metric, the business world continues to rely on it. Many companies perpetuate their use by continuing to set EBITDA targets, and their boards reinforce it by tying incentive compensation to EBITDA. Lenders often require minimum EBITDA coverage ratios in credit agreements, and the M&A market’s embrace of EBITDA multiples remains firmly entrenched.

While much maligned, EBITDA is not going anywhere. Despite its shortcomings, EBITDA can tell a story. When consistently defined within a company, trend analysis is an obvious use case. If you can glean the components of EBITDA from SEC filings or other sources, it can serve as a benchmark for competitive analysis, a common step in private equity playbooks when evaluating operational performance.

Like other GAAP and even non-GAAP metrics, EBITDA is not a standalone measure of corporate health. It can and should be used in conjunction with other metrics to help explain performance, identify risks and set targets. Defining EBITDA is a mix of art and science, which is why finance teams need a tool that brings transparency. An EBITDA bridge schedule does exactly that. We can bridge EBITDA to many helpful metrics, including budgeted and prior year EBITDA, gross margins and more. An EBITDA to cash flow bridge, however, provides the transparency and clarity that EBITDA alone lacks.

As the components building up to revenue and ultimately net income are derived and can be influenced and subject to interpretation and judgment, cash is always verifiable and far less susceptible to misstatement or error.

Building an EBITDA to cash flow bridge is straightforward. In my experience, a well-built bridge often reveals issues long before they surface in the financials. CFOs have been building this bridge informally for years, often without labeling it as such. We do it when discussing our results with management, investors, auditors and bankers. When EBITDA and cash flow diverge more than expected, we spend more time on this.

Finance leaders must understand and be able to articulate the reasons behind these variances. We also need to be prepared to discuss results with stakeholders. Beyond core operating performance, variance drivers can include accounting errors, fraud, unexpected balance sheet changes, the impact of contractual obligations and terms, as well as other items requiring further review.

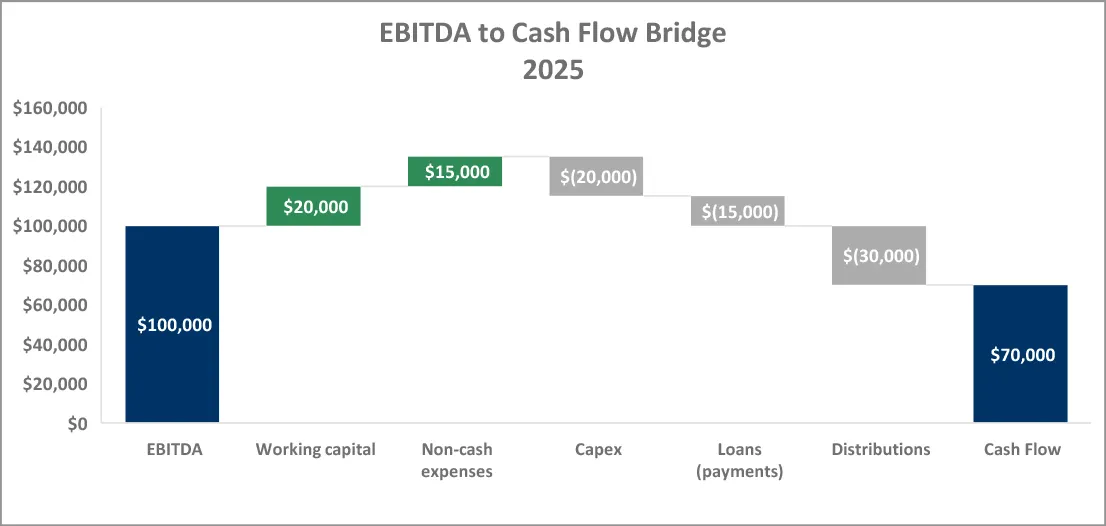

The bridge will take you from EBITDA to cash flow, highlighting the material items, and there are several ways to accomplish this. The chart below represents a commonly accepted style that clearly bridges EBITDA to cash flow, highlighting the balance sheet changes ignored by EBITDA.

Alternatively, the chart could show specific transactions or initiatives. It could also be time-delineated to highlight large working capital changes at the beginning or end of the period, which may have a disproportionate impact on the difference between EBITDA and cash flow. There are many ways to bridge these two items, and each company needs to highlight what is meaningful to them.

It is critical not only to be able to explain the journey from EBITDA to cash flow but also to compare it to the budget or expected results. That’s where finance leaders can gain additional leverage.

Adding the EBITDA build-up to the chart further strengthens the analysis, creating a comprehensive bridge from net income to EBITDA to cash flow and addressing many questions upfront.

At this point, you are probably thinking of all the possibilities you can explore. This type of analysis could be easily included in a monthly reporting package, prepared for board meetings, used for bank reporting and utilized in many other valuable ways. It should also be a foundational component of your internal analysis as something you rely on to prepare your commentary, even if it never appears in the final presentation.

For all its imperfections, EBITDA remains deeply embedded in how companies are evaluated and run. Rather than fighting its flaws, finance leaders can improve its usefulness by pairing it with a disciplined, transparent bridge to cash flow. Doing so transforms EBITDA into a diagnostic tool that reveals pressures in working capital dynamics, cash conversion and overall operational performance. It can also expose accounting or operational risks, and clarifies the quality of earnings behind the headline number, a concept that has taken on increased importance in today’s lending and private equity environment.

In a landscape where stakeholders demand clarity and credibility, the EBITDA to cash flow bridge isn’t a technical exercise; it’s a strategic one. CFOs who adopt it consistently will elevate their reporting, sharpen decision-making, and build well-informed stakeholders who are confident in the results.