The 2025 Finance and Accounting Technology Expo last week brought together CFOs, technology leaders, finance decision makers and technology providers for two days of discussions on modernization, data governance, AI adoption and the evolving finance tech stack.

Held at the Javits Center in New York City on Nov. 13 and 14, the event mixed mainstage sessions with hands-on demos and vendor conversations. The show also brought together CFOs, technology leaders, finance decision makers and technology providers for two days of discussions on modernization, data governance, AI adoption and the evolving finance tech stack.

Across sessions, hallway conversations and product briefings, several clear themes emerged about what CFOs are focused on and where finance operations are shifting. The following nine takeaways highlight the trends, tensions and signals that stood out over the two-day event and reflect the broader direction of the CFO’s role heading into 2026.

1. Decision makers are pushing technology vendors for clearer, more concrete answers

Across platform demos and product sessions, attendees asked questions focused on data extraction, integration failure rates, outage history, liability for broken reporting and protections against admin misuse. Few vendors were able to provide well-formulated specifics beyond broad marketing language. The tone suggested that finance leaders are raising the bar around transparency and due diligence when it comes to tech stacks.

2. Trust in cloud-based systems depends on what surrounds them

Rather than the finance technology space’s classic practice of debating which brands of enterprise resource planning systems are becoming obsolete, most conversations this time remained centered on how teams structure their work. Organizations operating with fewer surprises are anchoring tightly to a single system of record and limiting plug-ins and added systems. Problems, according to both vendors and attendees, tend to emerge when the ERP competes with multiple adjacent tools for authority. Attendees and demonstrations repeatedly mentioned the need for a clean, disciplined execution of an ERP implementation plan, process and timeline.

Without surprise, a frequent question that surfaced in nearly every product discussion was some version of “how does this incorporate into NetSuite?” which consistently produced a wide range of answers from vendors. Many attendees, like lots of CFOs across industries, are still dependent on the flexibility of legacy vendors when calibrating their ability to take on new technology in their finance function.

3. Fragmentation has become one of finance’s biggest operational liabilities

The long growth of lightweight add-on tools over time has created conflicting data definitions, redundant reporting layers and inconsistent logic across systems for many organizations. Fragmentation is increasingly seen as more damaging than the risks associated with being tied to one long-term platform.

Finance leaders widely acknowledged that execution slows when teams spend more time reconciling inconsistencies than performing actual work, particularly post-M&A, when different systems must combine or work adjacent to one another. Consolidation is becoming a strategic priority for high-performing organizations, particularly those that are on the buy-side of the M&A market.

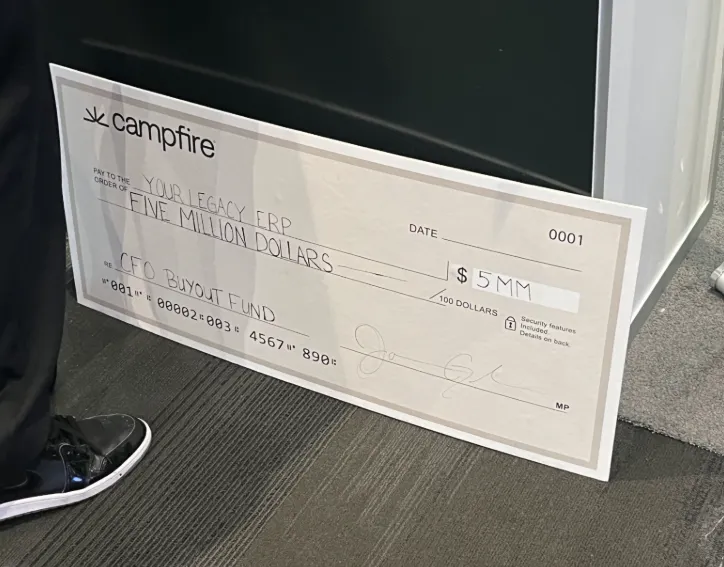

4. Big contract buyouts are becoming a standard competitive tactic

Vendors offering to buy out customers’ existing contracts came up repeatedly, underscoring how aggressively the finance tech sector is pursuing growth. One ERP provider was even offering a $5 million dollar buyout check to cover contract termination fees for CFOs willing to switch platforms.

While incentives like these can appeal to teams struggling with difficult implementations, they also create new long-term risks. Several leaders noted that switching systems under financial pressure often moves complexity rather than resolving it.

5. Tools that excel for smaller teams can struggle as organizations scale

Well-known workflow and AP platforms continue to generate strong early-stage satisfaction, especially for teams modernizing from manual processes. As organizations grow, however, additional reconciliation steps, ownership questions and visibility gaps continue to emerge. The discussions here focused on scalability, depth and process control. This, according to CFO Alliance President Nick Araco Jr., is why CFO sentiment around legacy vendors has waned.

6. CFO leadership expectations are expanding well beyond technical expertise

Sessions consistently emphasized that CFOs are now judged on direction-setting, prioritization and communication as much as on accounting and finance. Many teams are struggling less with skill gaps and more with uncertainty about what to focus on, given the rising tasks.

Multiple speakers, including President of the CFO Leadership Council Jack McCullough, reiterated that those CFOs who remove noise, set clear rhythms and create space for experimentation are outperforming peers. McCullogh shared his LIFT framework during a keynote session — leadership, innovation, finance and technology — that sharply captured the broader scope of today’s CFO role.

7. The CFO-CIO partnership is becoming the defining element of transformation

Organizations making real progress in modernization are aligning finance and technology functions around shared definitions, cadences and accountability. Numerous vendors made it a point to say that misalignment between these two groups remains one of the biggest inhibitors to finance’s digital transformation. Several discussions described the CFO–CIO relationship as the most important internal partnership in finance today.

8. CFOs are a bit overwhelmed by the noise around AI, not by AI itself

AI was widely viewed as valuable, but many leaders showed fatigue with the volume of competing pitches, use cases and promises. The progress stories that surfaced were tied to narrow, high-impact experimentation rather than broad, vendor-driven deployments. Attendees asked deliberate questions about data cleanup, guardrails and disciplined pilot programs.

Several vendors spewed CFO-AI rhetoric during their sessions, unsurprisingly selling that the gap between CFOs and AI utilization can be coincidentally filled by their product. However, many saw through the noise, and the consensus seemed to be that real momentum comes not from chasing every new tool, but from focus and clarity during a selective integration process.

9. Signals of declining CPA value were very visible

The CPA society areas drew noticeably light traffic, with several state tables sitting empty for long stretches. This was a physical representation of the declining prevalence and value of the CPA credential. During a keynote, McCullough and Ranga Bodla, NetSuite’s vice president of field engagement and marketing, contrasted the technical depth of the CPA with the broader leadership and innovation skills associated with the MBA.

That discussion and other conversations pointed to a widening perception gap between traditional accounting credentials and what today’s CFO roles demand. The empty tables, along with frequent references to FP&A experience and even non-finance routes like law or engineering, underscored how the CFO identity is shifting from the accounting pathway. The shift mirrors broader trends in the CFO talent market, where companies are increasingly prioritizing strategic and cross-functional experience over traditional accounting credentials.